This post originally appeared at https://reforminggovernment.org/court-watch-property-taxes-could-skyrocket-if-supreme-court-overturns-act-10/

For Immediate Release:

February 4, 2025

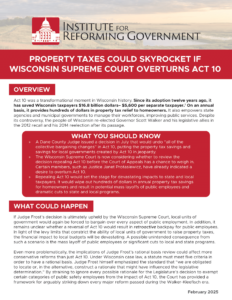

Court Watch: Property Taxes Could Skyrocket if Supreme Court Overturns Act 10

Delafield, Wis. – The Institute for Reforming Government (IRG) released another “Court Watch” primer outlining the consequences to taxpayers and local government if the Wisconsin Supreme Court overturns Act 10. The primer outlines the savings to taxpayers and local governments at stake along with the potential for mass layoffs and cuts.

Delafield, Wis. – The Institute for Reforming Government (IRG) released another “Court Watch” primer outlining the consequences to taxpayers and local government if the Wisconsin Supreme Court overturns Act 10. The primer outlines the savings to taxpayers and local governments at stake along with the potential for mass layoffs and cuts.

WHY IT MATTERS: Repealing Act 10 would set the stage for devastating impacts to state and local taxpayers. It would wipe out hundreds of dollars in annual property tax savings for homeowners and result in potential mass layoffs of public employees and dramatic cuts to state and local programs.

THE QUOTE: “If the Wisconsin Supreme Court affirms a Dane County Judge’s decision to repeal Act 10, Wisconsin taxpayers will pay the price,” said Jake Curtis, General Counsel and Director of CIO of IRG. “Wisconsinites must understand the potential cost if the Wisconsin Supreme Court decides they should foot the bill of repeal.”

WHAT’S NEXT: State courts impact everyday Wisconsinites’ lives and IRG’s new Court Watch initiative will lead in educating on the importance of the judicial branch.

Read the primer here.

###

The Institute for Reforming Government is a non-profit 501(c)3 organization that seeks to simplify government at every level by offering policy solutions to thought leaders in American government in the areas of tax reform, government inefficiency, and burdensome regulations. To view this press release online, click here.