This post originally appeared at https://www.badgerinstitute.org/mobile-taxpayers-would-decide-whether-evers-dream-of-higher-taxes-is-fair/

Governor talks of new 9.8% top rate — one that would wallop businesses that don’t flee

When Gov. Tony Evers announced he would wallop Wisconsinites with more than $2 billion in tax increases, the chair of the Democrat caucus in the state Senate, Milwaukee’s Chris Larson, blurted his enthusiasm on X.

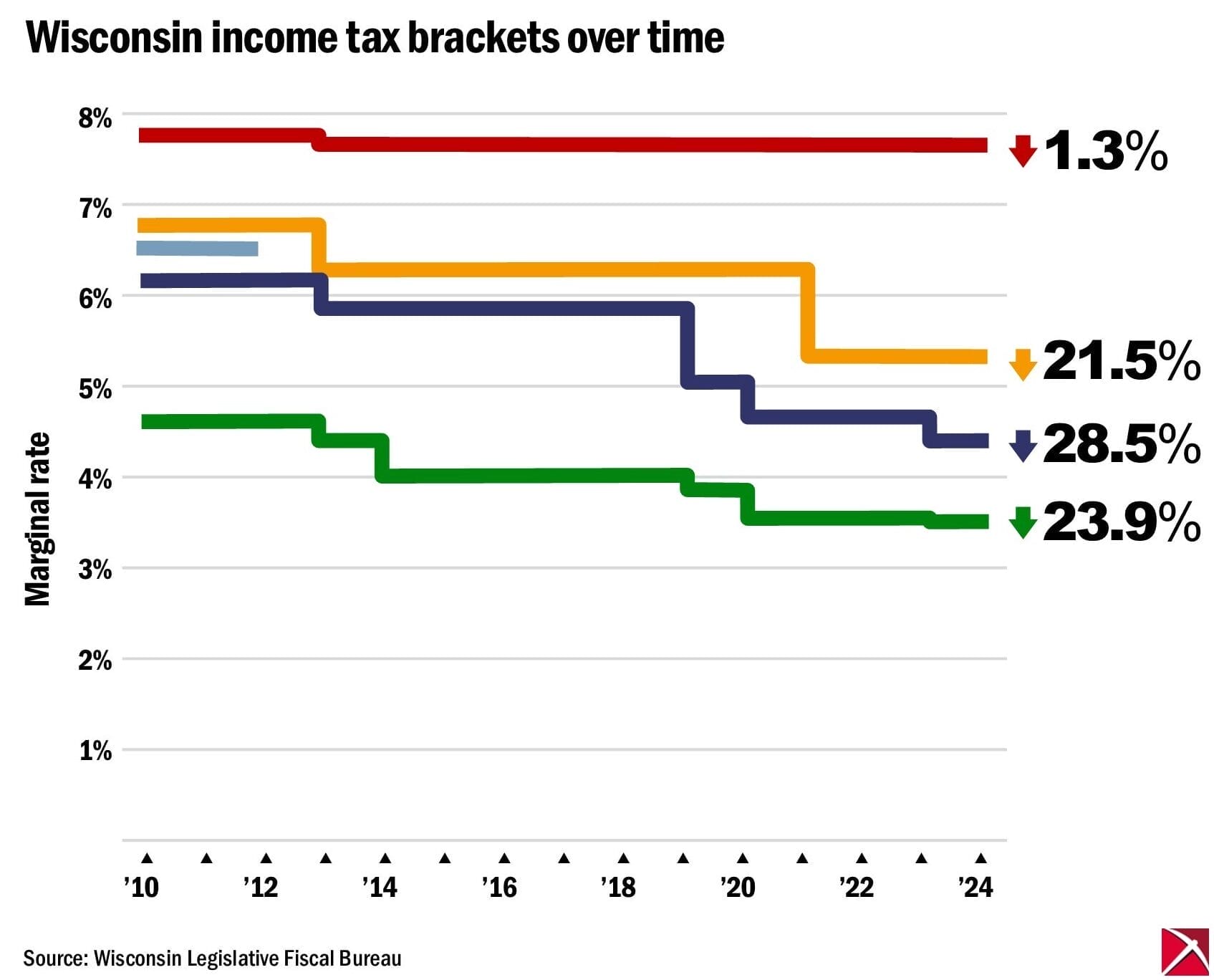

“Over the past decade-plus,” he wrote, Wisconsin’s “income tax rates have fallen across the board,” but the benefits went “mostly to the rich.”

Larson is simply wrong. Wisconsin’s progressive income tax currently has four brackets. People in the top bracket earn a bit under a quarter of all Wisconsin income but pay about a third of all income taxes. Their tax bills are disproportionately large, so the slightest cut means many dollars.

Since 2010, the top bracket has seen the least relief by rate, falling from 7.75% to 7.65%, a 1.3% decline. Every other bracket affecting every taxpayer earning less than $420,000 has been cut much more, from 19% to 29%.

As a share of income, the greatest income tax relief went to households earning at or below the median.

The senator went on to praise Evers’ plan to add a new top income tax rate as a way to make high earners “pay their fair share.” Evers praised himself in identical terms over his plan to keep the 7.65% rate but add an even higher one, 9.8%, on income over $1 million.

Is that a “fair share”? Evers can say so, but “fair” is a matter of opinion. He doesn’t know.

Who does? The taxpayers who will get hit with it. And if they decide it’s not fair, they don’t have to pay it. They can leave. Paying Wisconsin income taxes is, after all, voluntary because living here is.

The Republican majorities in the Legislature say they will build their own budget rather than assenting to the governor’s 20% increase in spending and his tax hikes. That would be a more honest move.

Evers also says his budget is “supporting small business” and economic development. His summary’s first 11 bullet points on such “support” announce new or expanded handouts of taxpayer money to businesses that do what the state wants or are of a favored ethnicity.

If Evers really wanted to support small business, he would reduce, not increase, Wisconsin’s top income tax rate.

Nearly every small business in Wisconsin, and some large ones, are taxed via their owners’ personal tax returns. Such “pass-through” businesses — usually sole proprietorships, family-owned firms that make up much of Wisconsin manufacturing, and so on — make up most of the income that Wisconsin now taxes at 7.65%, which is the 10th-highest top rate in America.

That rate already is higher than any other state between New York and California, except for Minnesota. It’s well above Illinois, Michigan, Indiana and Iowa.

And Evers is telling small businesses that, if he has his way, their reward for success will be a still higher rate as we become harsher than Massachusetts and Vermont. He wants Wisconsin to have the eighth highest top rate in America.

The governor talks of millionaires, but this arm-twist affects millions of Wisconsinites working for — or hoping to work for — companies that he’ll tax harder. That’s because the owners of those companies will have to make decisions about where they will grow or even remain.

Eight states do not tax personal income at all. Fourteen states tax it at one single proportionate rate for everyone. All it takes to keep much more of what your business earns is to put the new production line in Waco instead of Waupaca.

This is a key reason that reforming to a single-rate tax schedule would lead to a leap in business investment, employment and wealth creation for Wisconsinites, according to a 2023 study for the Badger Institute. A study in January from economists at the University of Wisconsin’s Center for Research on the Wisconsin Economy found similar results: A lower, single-rate tax would have “a significantly positive impact on Wisconsin’s economy.”

We already know that Wisconsinites with means flee our tax climate. We know that tax rates influence people’s moves. We know, from the IRS’ most recent figures, that just between 2021 and 2022, Wisconsin gained refugees from the savage tax environment of Minnesota and the harsh property taxes of Illinois, but that on the whole we lost more than 1,000 households and $300 million in the income they earned to other states.

Of the top five gainers of former Wisconsinites, four have no income taxes and the fifth, North Carolina, charges everyone 4.25%. Does Tony Evers think that’s unfairly low and that 9.8% is more fair?

He’s not the one to make that call.

Patrick McIlheran is the Director of Policy at the Badger Institute.

Any use or reproduction of Badger Institute articles or photographs requires prior written permission. To request permission to post articles on a website or print copies for distribution, contact Badger Institute President Mike Nichols at mike@badgerinstitute.org or 262-389-8239.

Submit a comment

“*” indicates required fields

/* = 0;if(!is_postback){return;}var form_content = jQuery(this).contents().find(‘#gform_wrapper_21’);var is_confirmation = jQuery(this).contents().find(‘#gform_confirmation_wrapper_21’).length > 0;var is_redirect = contents.indexOf(‘gformRedirect(){‘) >= 0;var is_form = form_content.length > 0 && ! is_redirect && ! is_confirmation;var mt = parseInt(jQuery(‘html’).css(‘margin-top’), 10) + parseInt(jQuery(‘body’).css(‘margin-top’), 10) + 100;if(is_form){jQuery(‘#gform_wrapper_21’).html(form_content.html());if(form_content.hasClass(‘gform_validation_error’)){jQuery(‘#gform_wrapper_21’).addClass(‘gform_validation_error’);} else {jQuery(‘#gform_wrapper_21’).removeClass(‘gform_validation_error’);}setTimeout( function() { /* delay the scroll by 50 milliseconds to fix a bug in chrome */ jQuery(document).scrollTop(jQuery(‘#gform_wrapper_21’).offset().top – mt); }, 50 );if(window[‘gformInitDatepicker’]) {gformInitDatepicker();}if(window[‘gformInitPriceFields’]) {gformInitPriceFields();}var current_page = jQuery(‘#gform_source_page_number_21’).val();gformInitSpinner( 21, ‘https://e74sq7k37a8.exactdn.com/wp-content/plugins/gravityforms/images/spinner.svg’, true );jQuery(document).trigger(‘gform_page_loaded’, [21, current_page]);window[‘gf_submitting_21’] = false;}else if(!is_redirect){var confirmation_content = jQuery(this).contents().find(‘.GF_AJAX_POSTBACK’).html();if(!confirmation_content){confirmation_content = contents;}jQuery(‘#gform_wrapper_21’).replaceWith(confirmation_content);jQuery(document).scrollTop(jQuery(‘#gf_21’).offset().top – mt);jQuery(document).trigger(‘gform_confirmation_loaded’, [21]);window[‘gf_submitting_21’] = false;wp.a11y.speak(jQuery(‘#gform_confirmation_message_21’).text());}else{jQuery(‘#gform_21’).append(contents);if(window[‘gformRedirect’]) {gformRedirect();}}jQuery(document).trigger(“gform_pre_post_render”, [{ formId: “21”, currentPage: “current_page”, abort: function() { this.preventDefault(); } }]); if (event && event.defaultPrevented) { return; } const gformWrapperDiv = document.getElementById( “gform_wrapper_21” ); if ( gformWrapperDiv ) { const visibilitySpan = document.createElement( “span” ); visibilitySpan.id = “gform_visibility_test_21”; gformWrapperDiv.insertAdjacentElement( “afterend”, visibilitySpan ); } const visibilityTestDiv = document.getElementById( “gform_visibility_test_21” ); let postRenderFired = false; function triggerPostRender() { if ( postRenderFired ) { return; } postRenderFired = true; jQuery( document ).trigger( ‘gform_post_render’, [21, current_page] ); gform.utils.trigger( { event: ‘gform/postRender’, native: false, data: { formId: 21, currentPage: current_page } } ); gform.utils.trigger( { event: ‘gform/post_render’, native: false, data: { formId: 21, currentPage: current_page } } ); if ( visibilityTestDiv ) { visibilityTestDiv.parentNode.removeChild( visibilityTestDiv ); } } function debounce( func, wait, immediate ) { var timeout; return function() { var context = this, args = arguments; var later = function() { timeout = null; if ( !immediate ) func.apply( context, args ); }; var callNow = immediate && !timeout; clearTimeout( timeout ); timeout = setTimeout( later, wait ); if ( callNow ) func.apply( context, args ); }; } const debouncedTriggerPostRender = debounce( function() { triggerPostRender(); }, 200 ); if ( visibilityTestDiv && visibilityTestDiv.offsetParent === null ) { const observer = new MutationObserver( ( mutations ) => { mutations.forEach( ( mutation ) => { if ( mutation.type === ‘attributes’ && visibilityTestDiv.offsetParent !== null ) { debouncedTriggerPostRender(); observer.disconnect(); } }); }); observer.observe( document.body, { attributes: true, childList: false, subtree: true, attributeFilter: [ ‘style’, ‘class’ ], }); } else { triggerPostRender(); } } );} );

/* ]]> */

The post Mobile taxpayers would decide whether Evers’ dream of higher taxes is ‘fair’ appeared first on Badger Institute.