This post originally appeared at https://www.badgerinstitute.org/wisconsin-voters-approved-majority-of-school-tax-hike-requests-last-tuesday/

“Yes” votes prevailed in 61% of school district referenda

Slightly more than 60% of school district requests to levy higher property taxes were approved by voters on last Tuesday’s ballots throughout the state — a lower percentage than in recent years but around the historic norm.

A total of 92 referenda were placed before voters on April 2, some asking for increases in taxes used to fund operations, some for building or maintenance projects. Approval rates in both instances were close to 60%.

A Badger Institute analysis found no simple, readily discernible pattern based on geography or amount sought or district size for referenda that were passed versus those that failed — something that is often the case when looking at referenda that occur on the same date, according to Dale Knapp, the director of Forward Analytics who authored a study last November, K-12 on the Ballot — Using Referenda to Fund Public Schools.

“Everything is so local,” said Knapp. “It is so dependent on the district communications with the public, whether there is a group out there opposed or in support.” A “vocal group out there, that can make a difference.”

Knapp’s study released last year looked only at referenda seeking increases in the revenue limits for operating expenditures.

Since 2011, 76% of referenda seeking revenue limit increases have been approved by voters, he found. Prior to 2011, and going back to 1997, only 44% passed. Overall, 58% have passed over the last 27 years.

There are some patterns over the longer period, according to Knapp’s study.

- Districts that have had a significant decline in enrollment are most likely to hold a referendum.

- Low revenue districts are less likely to use a referendum to seek funding. The top 90% of districts in terms of per-student revenues were twice as likely to use the referendum option as those in the bottom 10%.

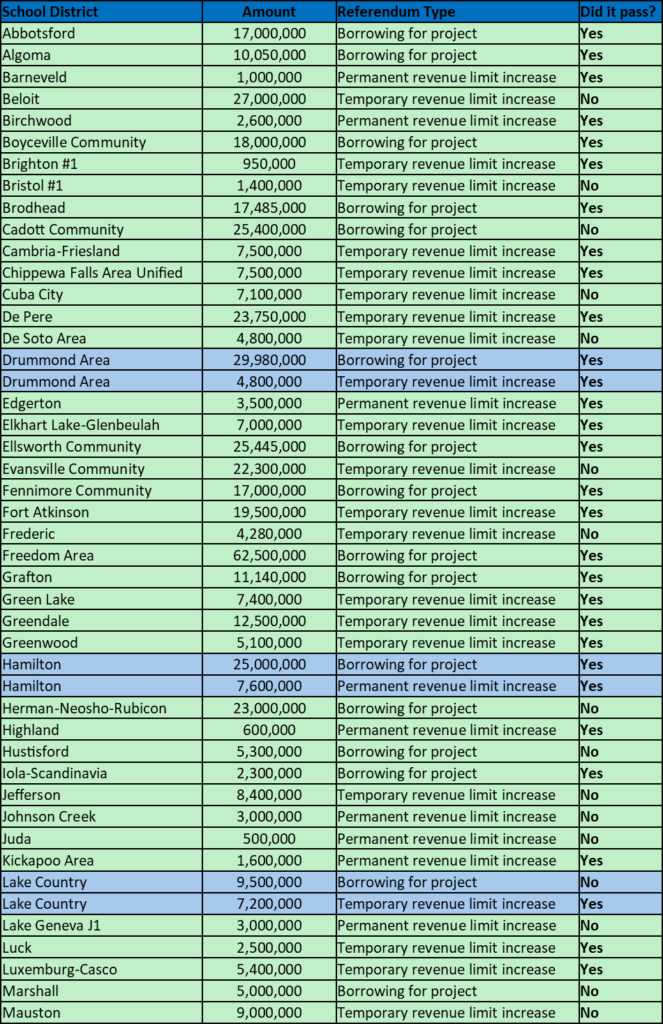

Based on unofficial vote counts for April 2 referenda, the Badger Institute found the following:

| Passed | Percent Passed | Failed | Percent Failed | Total | |

| Permanent revenue increase | 11 | 58% | 8 | 42% | 19 |

| Temporary revenue increase | 27 | 63% | 16 | 37% | 43 |

| Borrowing for project | 18 | 60% | 12 | 40% | 30 |

| Total | 56 | 61% | 36 | 39% | 92 |

Results throughout the state:

Mike Nichols is the President of the Badger Institute, Will Rosignal its Digital Outreach Associate. Permission to reprint is granted as long as the authors and Badger Institute are properly cited.

Submit a comment

“*” indicates required fields

/* = 0;if(!is_postback){return;}var form_content = jQuery(this).contents().find(‘#gform_wrapper_21’);var is_confirmation = jQuery(this).contents().find(‘#gform_confirmation_wrapper_21’).length > 0;var is_redirect = contents.indexOf(‘gformRedirect(){‘) >= 0;var is_form = form_content.length > 0 && ! is_redirect && ! is_confirmation;var mt = parseInt(jQuery(‘html’).css(‘margin-top’), 10) + parseInt(jQuery(‘body’).css(‘margin-top’), 10) + 100;if(is_form){jQuery(‘#gform_wrapper_21’).html(form_content.html());if(form_content.hasClass(‘gform_validation_error’)){jQuery(‘#gform_wrapper_21’).addClass(‘gform_validation_error’);} else {jQuery(‘#gform_wrapper_21’).removeClass(‘gform_validation_error’);}setTimeout( function() { /* delay the scroll by 50 milliseconds to fix a bug in chrome */ jQuery(document).scrollTop(jQuery(‘#gform_wrapper_21’).offset().top – mt); }, 50 );if(window[‘gformInitDatepicker’]) {gformInitDatepicker();}if(window[‘gformInitPriceFields’]) {gformInitPriceFields();}var current_page = jQuery(‘#gform_source_page_number_21’).val();gformInitSpinner( 21, ‘https://e74sq7k37a8.exactdn.com/wp-content/plugins/gravityforms/images/spinner.svg’, true );jQuery(document).trigger(‘gform_page_loaded’, [21, current_page]);window[‘gf_submitting_21’] = false;}else if(!is_redirect){var confirmation_content = jQuery(this).contents().find(‘.GF_AJAX_POSTBACK’).html();if(!confirmation_content){confirmation_content = contents;}setTimeout(function(){jQuery(‘#gform_wrapper_21’).replaceWith(confirmation_content);jQuery(document).scrollTop(jQuery(‘#gf_21’).offset().top – mt);jQuery(document).trigger(‘gform_confirmation_loaded’, [21]);window[‘gf_submitting_21’] = false;wp.a11y.speak(jQuery(‘#gform_confirmation_message_21’).text());}, 50);}else{jQuery(‘#gform_21’).append(contents);if(window[‘gformRedirect’]) {gformRedirect();}}jQuery(document).trigger(“gform_pre_post_render”, [{ formId: “21”, currentPage: “current_page”, abort: function() { this.preventDefault(); } }]); if (event.defaultPrevented) { return; } const gformWrapperDiv = document.getElementById( “gform_wrapper_21” ); if ( gformWrapperDiv ) { const visibilitySpan = document.createElement( “span” ); visibilitySpan.id = “gform_visibility_test_21”; gformWrapperDiv.insertAdjacentElement( “afterend”, visibilitySpan ); } const visibilityTestDiv = document.getElementById( “gform_visibility_test_21” ); let postRenderFired = false; function triggerPostRender() { if ( postRenderFired ) { return; } postRenderFired = true; jQuery( document ).trigger( ‘gform_post_render’, [21, current_page] ); gform.utils.trigger( { event: ‘gform/postRender’, native: false, data: { formId: 21, currentPage: current_page } } ); if ( visibilityTestDiv ) { visibilityTestDiv.parentNode.removeChild( visibilityTestDiv ); } } function debounce( func, wait, immediate ) { var timeout; return function() { var context = this, args = arguments; var later = function() { timeout = null; if ( !immediate ) func.apply( context, args ); }; var callNow = immediate && !timeout; clearTimeout( timeout ); timeout = setTimeout( later, wait ); if ( callNow ) func.apply( context, args ); }; } const debouncedTriggerPostRender = debounce( function() { triggerPostRender(); }, 200 ); if ( visibilityTestDiv && visibilityTestDiv.offsetParent === null ) { const observer = new MutationObserver( ( mutations ) => { mutations.forEach( ( mutation ) => { if ( mutation.type === ‘attributes’ && visibilityTestDiv.offsetParent !== null ) { debouncedTriggerPostRender(); observer.disconnect(); } }); }); observer.observe( document.body, { attributes: true, childList: false, subtree: true, attributeFilter: [ ‘style’, ‘class’ ], }); } else { triggerPostRender(); } } );} );

/* ]]> */

The post Wisconsin voters approved majority of school tax-hike requests last Tuesday appeared first on Badger Institute.