This post originally appeared at https://www.badgerinstitute.org/act-10-was-a-godsend-for-property-taxpayers/

The labor reform, threatened by court ruling, let teachers talk to bosses — but no longer dictate

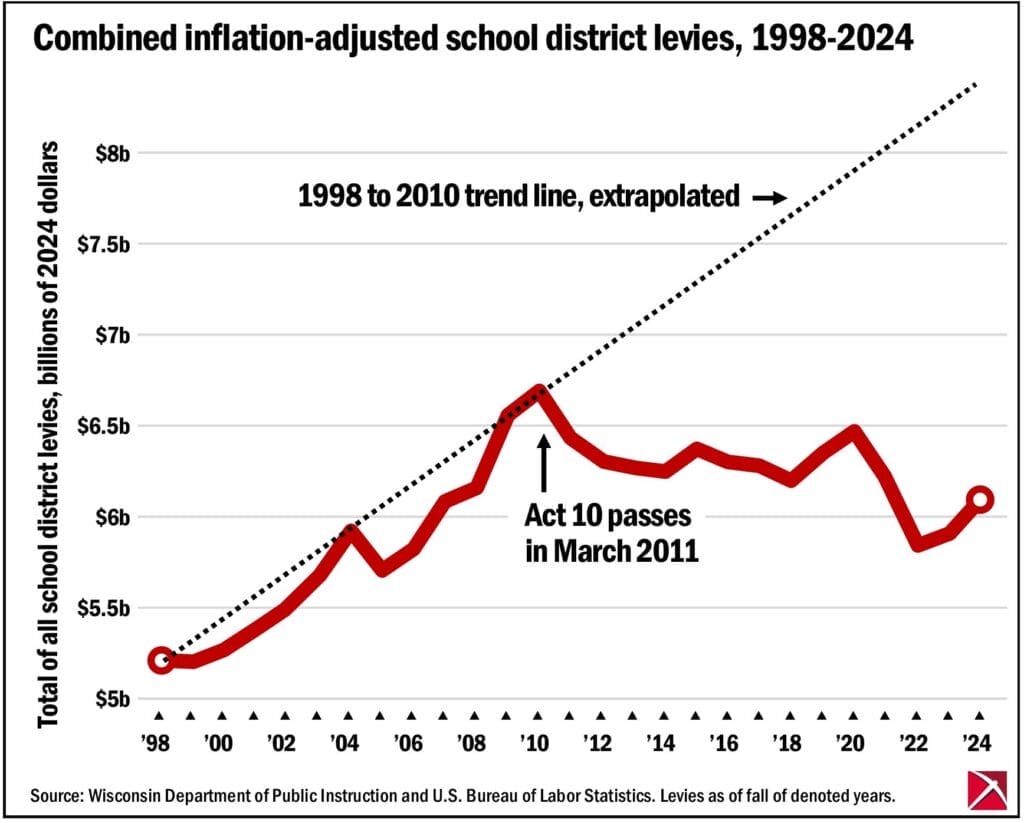

Look at the trajectory over the years of Wisconsin school levies — that is, the total of the property-tax burden that school districts load onto the backs of homeowners, rent-payers, bakery proprietors, so on — and the geometry leaps out.

After years of merciless ascent, tax increases moderated in 2011, the year of the Act 10 labor reforms.

To call property taxes a burden isn’t to doubt that schools are good. Wisconsin got to the Top 10 in property tax harshness by decades of taxpayers showing appreciation for schools and patience at their cost.

Respect for such patience, however, calls for some moderation in the ask. In 2011, the Legislature and then-Gov. Scott Walker took back the steering wheel from public sector unions that had been driving us into poorhouse at a rate more than 2 points above inflation a year. The reforms gave fiscal control back to school boards and common councils — and the voters who choose them — and led to school levies that rose with the rate of inflation instead of outstripping it practically every single, solitary year.

In the 12 years leading up to Act 10, school levies statewide rose 72%, compared to 31% in the dozen years after that up to and including 2024. After you adjust for inflation, in the 12 years before Act 10, the levies rose 2.15% a year, average, in real-dollar terms. In the past 12 years, they’ve averaged a quarter-point below inflation.

Well, break’s over, maybe.

A Dane County judge this month struck down the act 13 years after the fact, ostensibly because it treated some government employees differently than others — a legal argument that appeared to have been settled by the state Supreme Court in 2014. The real reason: Government-employee unions are as jealous of their lost privileges as Vladimir Putin is of Ukrainian wheatfields, and they never, ever gave up.

What do they fight for? Money, sure, but mostly power. They say as much, if you translate the histrionics.

“When the law changed, teachers like me lost the ability to sit across from our employers and talk about things that matter to our students and to each of us in the classroom,” the head of Wisconsin’s largest teachers union, Peggy Wirtz-Olsen, told a newspaper.

It’s the same nonsense you’ve heard for years from public-sector unions. Wirtz-Olsen remained perfectly free to sit down with her principal at Port Washington High School and talk. You know — the way it operates in most workplaces, big, small, good or bad. No law barred her from seeing if the superintendent had a moment for one of the district’s 170 teachers, and like any member of the public she could address the elected school board. Failing all that, she was free to find a more talkative employer among Wisconsin’s 420 school districts.

What Wirtz-Olsen means, one suspects, is not that teachers couldn’t talk to their employers but that they could no longer dictate to them. No longer could unions dictate work rules or order taxpayers to cover employees’ share of pension contributions or skim dues without asking from colleagues unwilling to join up. They lost the power to strong-arm school districts into buying health coverage from an overpriced union-owned insurer. Districts switched and saved millions on better coverage.

Now? With Act 10 perhaps on the way out, unions are rushing to change the curve in that graph. Two days after the judge ruled, the union in Madison’s school district demanded — their word — to bargain over “terms and conditions.” The union three months before had won the maximum permitted raise from the district. In November, Madison voters agreed to raise property taxes — by about $1,375 on the average home, every year for the next quarter-century.

But that was then. Now, unless the Supreme Court contradicts the judge, unions aren’t in the position of having to ask. Now, without Act 10, they can command. As in, “Give me your wallet.”

Unions will say it’s about the boss, but they won’t point out that “boss” means you, the voters, any more than they’ll admit that the labor reforms led to measurably better government. Reforms let school districts break out of strict seniority-and-degree pay scales. If Act 10’s really gone, reform-minded districts likely will lose their ability to innovate better rewards for high-quality teaching. At risk: “Offering higher compensation for hard to fill positions, offering merit pay and the ability to bonus outstanding efforts by employees, offering to compensate for specific continuing education, and ability to assign teachers to special leadership roles,” New Berlin’s superintendent, Joe Garza, told the Wisconsin Institute for Law & Liberty last spring.

Districts can do those things, and those that do them produce measurably better results for children, as economist Barbara Biasi found in 2023. She’s not the only one. For the public, it’s not just about the money but quality services.

But it is about the money, too.

The reforms gave taxpayers such a breather, voters in about a third of Wisconsin districts agreed they could afford to exceed limits on tax increases, meaning levies are rising 5.7% this year over last.

See? Treat taxpayers reasonably and ask politely, and they’ll often say yes. If the Dane County judge’s overturning of long-settled matters stands, you’ll be told and not asked.

Patrick McIlheran is the Director of Policy at the Badger Institute.

Any use or reproduction of Badger Institute articles or photographs requires prior written permission. To request permission to post articles on a website or print copies for distribution, contact Badger Institute President Mike Nichols at mike@badgerinstitute.org or 262-389-8239.

var gform;gform||(document.addEventListener(“gform_main_scripts_loaded”,function(){gform.scriptsLoaded=!0}),document.addEventListener(“gform/theme/scripts_loaded”,function(){gform.themeScriptsLoaded=!0}),window.addEventListener(“DOMContentLoaded”,function(){gform.domLoaded=!0}),gform={domLoaded:!1,scriptsLoaded:!1,themeScriptsLoaded:!1,isFormEditor:()=>”function”==typeof InitializeEditor,callIfLoaded:function(o){return!(!gform.domLoaded||!gform.scriptsLoaded||!gform.themeScriptsLoaded&&!gform.isFormEditor()||(gform.isFormEditor()&&console.warn(“The use of gform.initializeOnLoaded() is deprecated in the form editor context and will be removed in Gravity Forms 3.1.”),o(),0))},initializeOnLoaded:function(o){gform.callIfLoaded(o)||(document.addEventListener(“gform_main_scripts_loaded”,()=>{gform.scriptsLoaded=!0,gform.callIfLoaded(o)}),document.addEventListener(“gform/theme/scripts_loaded”,()=>{gform.themeScriptsLoaded=!0,gform.callIfLoaded(o)}),window.addEventListener(“DOMContentLoaded”,()=>{gform.domLoaded=!0,gform.callIfLoaded(o)}))},hooks:{action:{},filter:{}},addAction:function(o,r,e,t){gform.addHook(“action”,o,r,e,t)},addFilter:function(o,r,e,t){gform.addHook(“filter”,o,r,e,t)},doAction:function(o){gform.doHook(“action”,o,arguments)},applyFilters:function(o){return gform.doHook(“filter”,o,arguments)},removeAction:function(o,r){gform.removeHook(“action”,o,r)},removeFilter:function(o,r,e){gform.removeHook(“filter”,o,r,e)},addHook:function(o,r,e,t,n){null==gform.hooks[o][r]&&(gform.hooks[o][r]=[]);var d=gform.hooks[o][r];null==n&&(n=r+”_”+d.length),gform.hooks[o][r].push({tag:n,callable:e,priority:t=null==t?10:t})},doHook:function(r,o,e){var t;if(e=Array.prototype.slice.call(e,1),null!=gform.hooks[r][o]&&((o=gform.hooks[r][o]).sort(function(o,r){return o.priority-r.priority}),o.forEach(function(o){“function”!=typeof(t=o.callable)&&(t=window[t]),”action”==r?t.apply(null,e):e[0]=t.apply(null,e)})),”filter”==r)return e[0]},removeHook:function(o,r,t,n){var e;null!=gform.hooks[o][r]&&(e=(e=gform.hooks[o][r]).filter(function(o,r,e){return!!(null!=n&&n!=o.tag||null!=t&&t!=o.priority)}),gform.hooks[o][r]=e)}});

Submit a comment

“*” indicates required fields

/* = 0;if(!is_postback){return;}var form_content = jQuery(this).contents().find(‘#gform_wrapper_21’);var is_confirmation = jQuery(this).contents().find(‘#gform_confirmation_wrapper_21’).length > 0;var is_redirect = contents.indexOf(‘gformRedirect(){‘) >= 0;var is_form = form_content.length > 0 && ! is_redirect && ! is_confirmation;var mt = parseInt(jQuery(‘html’).css(‘margin-top’), 10) + parseInt(jQuery(‘body’).css(‘margin-top’), 10) + 100;if(is_form){jQuery(‘#gform_wrapper_21’).html(form_content.html());if(form_content.hasClass(‘gform_validation_error’)){jQuery(‘#gform_wrapper_21’).addClass(‘gform_validation_error’);} else {jQuery(‘#gform_wrapper_21’).removeClass(‘gform_validation_error’);}setTimeout( function() { /* delay the scroll by 50 milliseconds to fix a bug in chrome */ jQuery(document).scrollTop(jQuery(‘#gform_wrapper_21’).offset().top – mt); }, 50 );if(window[‘gformInitDatepicker’]) {gformInitDatepicker();}if(window[‘gformInitPriceFields’]) {gformInitPriceFields();}var current_page = jQuery(‘#gform_source_page_number_21’).val();gformInitSpinner( 21, ‘https://e74sq7k37a8.exactdn.com/wp-content/plugins/gravityforms/images/spinner.svg’, true );jQuery(document).trigger(‘gform_page_loaded’, [21, current_page]);window[‘gf_submitting_21’] = false;}else if(!is_redirect){var confirmation_content = jQuery(this).contents().find(‘.GF_AJAX_POSTBACK’).html();if(!confirmation_content){confirmation_content = contents;}jQuery(‘#gform_wrapper_21’).replaceWith(confirmation_content);jQuery(document).scrollTop(jQuery(‘#gf_21’).offset().top – mt);jQuery(document).trigger(‘gform_confirmation_loaded’, [21]);window[‘gf_submitting_21’] = false;wp.a11y.speak(jQuery(‘#gform_confirmation_message_21’).text());}else{jQuery(‘#gform_21’).append(contents);if(window[‘gformRedirect’]) {gformRedirect();}}jQuery(document).trigger(“gform_pre_post_render”, [{ formId: “21”, currentPage: “current_page”, abort: function() { this.preventDefault(); } }]); if (event && event.defaultPrevented) { return; } const gformWrapperDiv = document.getElementById( “gform_wrapper_21” ); if ( gformWrapperDiv ) { const visibilitySpan = document.createElement( “span” ); visibilitySpan.id = “gform_visibility_test_21”; gformWrapperDiv.insertAdjacentElement( “afterend”, visibilitySpan ); } const visibilityTestDiv = document.getElementById( “gform_visibility_test_21” ); let postRenderFired = false; function triggerPostRender() { if ( postRenderFired ) { return; } postRenderFired = true; jQuery( document ).trigger( ‘gform_post_render’, [21, current_page] ); gform.utils.trigger( { event: ‘gform/postRender’, native: false, data: { formId: 21, currentPage: current_page } } ); gform.utils.trigger( { event: ‘gform/post_render’, native: false, data: { formId: 21, currentPage: current_page } } ); if ( visibilityTestDiv ) { visibilityTestDiv.parentNode.removeChild( visibilityTestDiv ); } } function debounce( func, wait, immediate ) { var timeout; return function() { var context = this, args = arguments; var later = function() { timeout = null; if ( !immediate ) func.apply( context, args ); }; var callNow = immediate && !timeout; clearTimeout( timeout ); timeout = setTimeout( later, wait ); if ( callNow ) func.apply( context, args ); }; } const debouncedTriggerPostRender = debounce( function() { triggerPostRender(); }, 200 ); if ( visibilityTestDiv && visibilityTestDiv.offsetParent === null ) { const observer = new MutationObserver( ( mutations ) => { mutations.forEach( ( mutation ) => { if ( mutation.type === ‘attributes’ && visibilityTestDiv.offsetParent !== null ) { debouncedTriggerPostRender(); observer.disconnect(); } }); }); observer.observe( document.body, { attributes: true, childList: false, subtree: true, attributeFilter: [ ‘style’, ‘class’ ], }); } else { triggerPostRender(); } } );} );

/* ]]> */

The post Act 10 was a godsend for property taxpayers appeared first on Badger Institute.